Basic Approach to Corporate Governance

Under the Corporate Philosophy of "fulfilling our role as a public entity of society," we aim to "continue to be a global company indispensable to society by improving the expertise of each group company and contributing to the expansion of corporate value for our customers."

We also stay true to our Credo (Value, Integrity, Professionalism, Diversity, Judgment) and strive to grow the entire Group in a sustainable manner and to enhance its value to society and medium- to long-term corporate value for shareholders and other stakeholders. In order to achieve this, we have been working to improve our internal control system and further enhance our corporate governance through efforts such as establishing and enforcing the Ethics and Compliance Regulations, ensuring that our officers and employees strictly comply with laws, regulations and the Articles of Incorporation together with strengthening our risk management system.

Basic Policy on Corporate Governance/Corporate Governance Report

https://www.takara-

company.co.jp/english/

ir/policy/cg.html

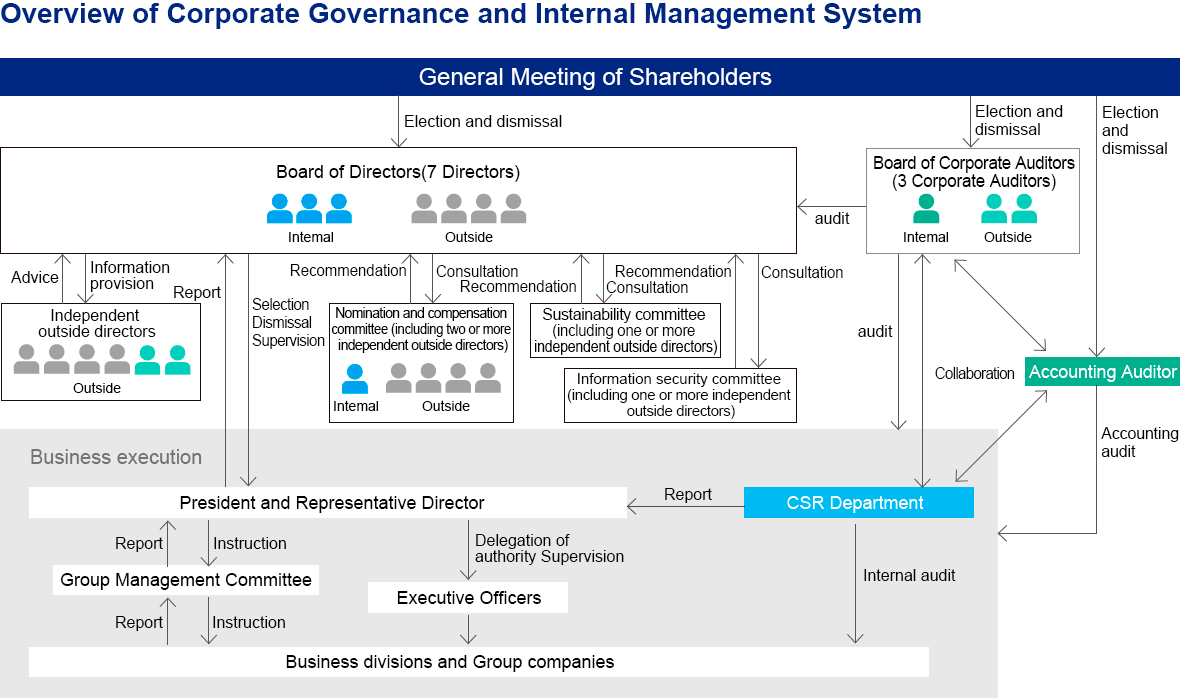

Board of Directors

The Board of Directors places emphasis on mobility in light of the company's size, etc., and has a structure of seven members, including four outside directors. In principle, the board of directors holds regular board meetings once a month, and special board meetings when necessary, determining matters stipulated by law and important management matters, and overseeing the status of business execution.

The Board of Directors, as entrusted by shareholders, is responsible for realizing and valuing efficient and effective corporate governance while carefully discussing the sustainability of the Company from a multifaceted perspective in order to increase the Company's medium- to long-term corporate value and increase its own profits for all shareholders, and is responsible for ensuring the Company's sustainable growth and increasing its social presence and corporate value. In order to fulfill this responsibility, the Board of Directors will make important decisions such as investments in human capital and intellectual property, and ensure the allocation of management resources, including these, and the implementation of strategies regarding the business portfolio, in order to contribute to the sustainable growth of the Company. In addition, the Board of Directors will exercise its supervisory function over management overall to ensure the fairness and transparency of management, while keeping in mind the evaluation of important risks that we determine, the determination of countermeasures, and each important business execution decision, and will work with our customers in mind. The Board of Directors will establish a system to ensure internal control throughout the Group, and will utilize the Internal Audit Department to oversee the operation of internal control. The Board of Directors considers the appointment of effective directors to be one of its main roles and responsibilities, and will appropriately evaluate the company's performance, etc., and properly reflect that evaluation in the personnel decisions of executive officers.

Audit System and Status of Audit

The Board of Corporate Auditors has one Standing Corporate Auditor and two Outside Corporate Auditors. Each Corporate Auditor audits the legality of business execution based on the Corporate Auditors' auditing criteria, audit plans and allocation of duties, which are determined by the Board of Corporate Auditors. The two Outside Corporate Auditors are an attorney-at-law and a certified public accountant, and conduct audits from their specialist perspectives.

With respect to the internal audit system, the Company has assigned three employees to the CSR Department. They investigate and check whether the development and improvement of the internal control system under the Companies Act and the Financial Instruments and Exchange Act and relevant business execution conform to laws and regulations as well as the Company's internal regulations and management plan, and whether they are implemented effectively and efficiently. Through these measures, they conduct internal audits to offer guidance and facilitate improvement.

Corporate Auditors and the CSR Department, which is the internal audit division, share, explain and report each other's audit plans, share information on the efficiency of work (including appropriateness of financial reporting), and jointly implement internal control measures under the Companies Act and the Financial Instruments and Exchange Act. As such, they collaborate in conducting audits by sharing information on general CSR management.

Furthermore, Corporate Auditors and the Accounting Auditor strive to enhance the quality of audits by sharing, explaining and reporting each other's audit plans, and sharing information on the audit environment and other issues unique to the Company by conducting regular interviews.

Outside Officers, etc.

Outside directors are selected from individuals with extensive experience and deep insight who are able to make thoughtful, thoughtful decisions from a neutral standpoint independent of the management team that executes the Company's business operations during decision-making processes related to important business operations, such as at the Board of Directors meetings.

Outside auditors are selected from individuals with specialized knowledge and experience as certified public accountants or lawyers, so that fair and impartial decisions that take into consideration the interests of general shareholders are made in the decision-making process regarding important business operations at the board of directors meetings and other such processes.

In order to strengthen the independence, objectivity and accountability of the Board of Directors' functions regarding the selection of directors (including succession planning) and compensation, etc., the Company has established a Nomination and Compensation Committee under the Board of Directors, whose main members are independent outside directors, to be appropriately and temporarily involved in the consideration of particularly important matters such as compensation.

In addition, with the aim of heightening the importance of information security and rebuilding an even stricter, more optimal information management system for the Group, we have established an Information Security Committee under our Board of Directors as a dialogue body for the Board of Directors, whose main members are independent outside directors.

Furthermore, we have established a Sustainability Committee under our Board of Directors as a discussion body for the Board of Directors (see page 50). The committee's main members are independent outside directors and outside experts.

The Company has established an Independent Outside Directors Board under the Board of Directors, which is composed of independent outside directors. The Board freely discusses matters related to the Company's business and corporate governance from an independent and objective standpoint, and offers proposals and advice on how to increase corporate value over the medium to long term with an eye toward sustainable growth for the company.

Executive Officers, Management Committee

The Company has adopted an executive officer system to ensure that management and execution roles are appropriately played.

Executive officers execute business operations based on authority delegated to them by the Board of Directors.

Based on the prior deliberation of items to be submitted to the Board of Directors and the basic policy decided by the Board of Directors, the Company holds a Group Management Meeting once a month in principle, which serves as a consultative body for the execution of business operations, etc., and is comprised of managing directors, full-time auditors, and key directors who are managing executive officers or above.

Approach to Diversity and Scale of the Board of Directors (Related CG Code 4.11.1)

Our directors must possess excellent character, insight, ability and abundant experience as well as high ethical standards, and we give consideration to the diversity of those who make up our Board of Directors.

The number of members of our Board of Directors will be between three and nine, of which at least one-third shall be independent outside directors. All directors shall serve a term of one year and be subject to election each year by resolution of the General Meeting of Shareholders.

Candidates for directors, including substitute directors, shall be selected in accordance with the above provisions with advice from the Nomination and Compensation Committee. Candidates for independent outside directors shall, in addition to meeting the qualifications for director, be individuals who have the broad and deep, abundant experience and deep insight necessary to make management decisions from a neutral standpoint independent of the management team that executes the Company's business, and shall be determined by the Board of Directors in accordance with the independence criteria set forth by the Tokyo Stock Exchange.

The Board of Directors identifies the skills that each director should possess in light of the business strategy, and then creates a skills matrix for directors in line with the Board of Directors' overall view on the balance of knowledge, experience and ability, as well as diversity, etc.

Assessment of Effectiveness of the Board of Directors (Related CG Code: 4.11.3)

The Company will disclose a summary of the results of its analysis and evaluation of the overall effectiveness of the Board of Directors for each fiscal year, based on the self-evaluation of each director at the Board of Directors meetings.

Regarding the effectiveness of the Board of Directors for the 87th fiscal year (ending May 2024), each director's self-evaluation was compiled through a signed questionnaire on matters including 1. composition of the Board of Directors, 2. status of deliberations at the Board of Directors, and 3. future issues. Based on this, the Board of Directors analyzed and evaluated the effectiveness of the Board of Directors, and came to the conclusion that the Board of Directors is generally effective.

The most commendable aspects were that a culture of free and open discussion has been fostered, as in the previous year, and that the content of deliberations was based on the perspective of qualitative importance, such as its business significance.

On the other hand, there were also comments that further consideration is needed regarding the direction of global corporate strategies.

We will continue to work to achieve sustainable growth and improve our corporate value over the medium to long term.

Policy for Officers' Selection and Dismissal (Related CG Code: 3.1.iv)

Our directors must be individuals of excellent character, with the insight, ability and abundant experience to manage our company accurately, fairly and efficiently, as well as high ethical standards.Additionally, the Company considers the diversity of those who make up its Board of Directors.All directors serve a term of one year and are subject to election by resolution of the Ordinary General Meeting of Shareholders.Candidates for directors, including alternate directors, are selected in accordance with the above provisions upon recommendation by the Nomination and Remuneration Committee, and candidates for independent outside directors are determined by the Board of Directors, taking into account not only the qualifications for directors but also the independence criteria set forth by the Tokyo Stock Exchange.Our Audit & Supervisory Board Members must be individuals of excellent character, with the insight, ability and abundant experience to audit the performance of the directors' duties accurately, fairly and efficiently, as well as high ethical standards and appropriate knowledge of finance, accounting and legal affairs.Additionally, the Company considers the diversity of those who make up the Audit & Supervisory Board.Candidates for new Audit & Supervisory Board Members, including substitute Audit & Supervisory Board Members, will be selected upon recommendation by the Nomination and Remuneration Committee in accordance with the above provisions and, following the consent of the Audit & Supervisory Board, will be decided by the Board of Directors.

If a director is found to have violated laws and regulations or been negligent in his/her duties, the Nomination and Compensation Committee will deliberate on the matter in a timely manner, and the Board of Directors will deliberate on dismissal based on the results of the deliberations by the Nomination and Compensation Committee. The appointment and dismissal of Audit & Supervisory Board Members and Executive Officers shall be decided by the Board of Directors in the same manner as the appointment and dismissal of Directors.

Policy for Officer Training and Support Scheme (Related CG Code: 4.14.2)

In order to fulfill their roles, directors and auditors must always actively gather information and continue to study regarding the Company's financial position, compliance with laws and regulations, corporate governance, and other issues.

In addition, through management, directors and auditors will become familiar with laws and regulations, rules of self-regulatory organizations such as financial instruments exchanges, and trends and realities regarding statutory disclosure, disclosure requested by self-regulatory organizations, and voluntary disclosure, and the Company will provide necessary opportunities for training for directors and auditors.

The Corporate Planning Department is responsible for supporting outside directors, while the full-time Audit & Supervisory Board members are responsible for supporting outside Audit & Supervisory Board members.

Additionally, we strive to communicate information by distributing relevant materials in advance of each Board of Directors and Board of Auditors meeting, as well as distributing internal notices in a timely manner.

Cross-shareholdings (Related CG Codes 1-4)

Regarding the classification of investment shares held for pure investment purposes and investment shares held for other purposes, the Company classifies shares held for business strategic purposes, such as maintaining and strengthening relationships with business partners, as cross-shareholdings, and shares held for other asset management purposes as pure investment purposes.

The purpose of cross-shareholdings at our company is to increase corporate value through maintaining, strengthening and coordinating business relationships within the Group. If a company makes a comprehensive judgment in light of the objective of increasing corporate value and determines that there is no significance to holding the shares, the company will, in principle, sell the shares.

The Company regularly checks the business transaction relationships, etc. of each individual stock within the Group.

Each quarter, we report to the Board of Directors on whether our holdings are being handled in accordance with our holding policy, taking into account the business relationships and capital costs of each individual stock within our group.

With regard to the exercise of voting rights for cross-shareholdings, we make a comprehensive judgment based on whether the proposal will contribute to increasing the value of the shares in question, taking into account the Group's business transaction relationships and capital costs.

Policy on constructive dialogue with shareholders (Related CG Code 5-1)

The CEO will endeavor to ensure that the opinions of shareholders are shared with the entire Board of Directors.

The Company will strive to disclose sufficient and necessary information in a timely and appropriate manner through statutory disclosure in accordance with the Companies Act, the Financial Instruments and Exchange Act and other relevant laws and regulations, disclosure requested by self-regulatory organizations, and voluntary disclosure such as for investor relations, and the management team (including executive officers), directors including outside officers, and auditors will engage in constructive dialogue with shareholders.

In doing so, we will strictly manage insider information and take great care to ensure that no substantial information disparity arises among shareholders.

The Company strives to establish a system for promoting constructive dialogue with shareholders. In principle, requests for dialogue from shareholders are handled by at least two people: one person of executive officer rank or higher and one person in charge of public relations and investor relations in the General Affairs Department. The General Affairs Department plays a central role in coordinating with the Accounting Department and the President's Office, etc., and strives to respond to such requests within a reasonable scope.

The main themes for dialogue with institutional investors, securities analysts and others in the 87th fiscal year (ending May 2024) will be the Group's role in the capital market, industry trends, our approach to capital costs, our medium-term management plan, and future growth drivers. In addition to individual interviews, we will hold financial results briefings and publish their distribution on our website to provide shareholders with appropriate explanations of our business status. The content of each dialogue is provided as feedback to the President and CEO and is reported to executives and relevant departments as appropriate in order to serve as a reference for management and to work toward continually improving corporate value.

Basic Policy on Capital Policy (Related CG Code: 1.3)

1. Basic Approach to Capital Policy

In order for the Group to earn appropriate profits necessary for shareholder return and improve corporate value and the common interests of shareholders sustainably over the medium to long term, it is crucial to maintain and develop good relationships with various stakeholders, including shareholders, employees, customers, suppliers, creditors and local communities. At the same time, the Group needs to manage business while being fully mindful of the interests of these stakeholders, with the prerequisite of earning customers' trust. It is such a management policy that is fundamental to maintaining the Company's superiority in the field of disclosure.

With regard to the services of each business, it is expected that it will be necessary to increase added value more than ever before and to make upfront investments to develop and nurture new businesses.

The Group believes that it has been able to secure internal reserves necessary for conducting business smoothly in a stable business environment. However, on the assumption of changes in the business environment, the Group will allocate its internal reserves to business investments and use capital effectively with leverage as necessary, since loan conditions are more favorable than ever before.

2. Cost of Capital

It will likely take some time before the new businesses we are developing and fostering earn the trust of our customers and generate profits. Business development will therefore need to be premised on operating income from existing businesses for the time being. Therefore, the Group will secure funds for shareholder return by effectively using low-cost interest-bearing debt and reduce the cost of capital.

Remuneration Policy(Related CG code 3-1 (iii))

At our company, the Board of Directors has the authority to decide on the policy regarding the amount of remuneration for executives and the method of calculation thereof. The content of remuneration is to be appropriate, fair and balanced, taking into consideration a comprehensive range of factors such as duties, business performance and contribution, in order to link the amount to shareholders' medium- to long-term interests and contribute to the sustainable growth of the Group and to increasing its social presence and corporate value, while also further motivating directors. Remuneration for independent outside directors shall reflect the responsibilities of each independent outside director and shall not include stock-related remuneration or other performance-linked elements.

At the 87th Ordinary General Meeting of Shareholders held on August 23, 2024, the amount of remuneration for our directors was resolved to be up to 180 million yen per year (of which, up to 50 million yen per year for outside directors, does not include the employee salaries of directors who also serve as employees). As of the conclusion of this General Meeting of Shareholders, the number of directors will be seven (four of which are outside directors).

Additionally, at the 69th Ordinary General Meeting of Shareholders held on August 24, 2006, a resolution was passed limiting annual compensation to Audit & Supervisory Board members to 40 million yen. As of the conclusion of this General Meeting of Shareholders, the number of Audit & Supervisory Board Members will be four (including two outside Audit & Supervisory Board Members).

Remuneration for directors consists of basic remuneration, performance-linked remuneration (executive bonuses) as a short-term incentive, and restricted stock remuneration (excluding part-time directors and outside directors) as a medium- to long-term incentive.

The amount of remuneration for Directors will be decided by the Board of Directors in accordance with the policy for decision-making established by the Company in accordance with the above, following prior consultation with the Nomination and Remuneration Committee by the Representative Director and President. Individual basic remuneration amounts are set according to the capabilities and roles of each officer, taking into account factors such as the business environment and based on what is considered to be an appropriate public standard. Performance-linked remuneration (officers' bonuses) is, in principle, evaluated according to the achievement status of each fiscal year using performance indicators (sales, operating profit, and net income attributable to owners of parent) set out in the medium-term management plan, as well as planned values for ROE (return on equity), which places emphasis on invested capital efficiency. With regard to retirement benefits for executives (hereinafter referred to as the "Plan"), these have been calculated based on the duties and years of service of the Company in accordance with the provisions of the Company's Regulations for Retirement Benefits for Executives, subject to a resolution at the General Meeting of Shareholders. However, as part of a review of the executive compensation system, the Company has introduced a restricted stock grant system (hereinafter referred to as the "RS") for full-time directors, etc., from fiscal 2019. In order to abolish the Plan, which has a deferred payment element, and to consolidate it into RS, the Board of Directors resolved to abolish the Plan at the Board of Directors meeting held on July 8, 2022, and will resolve to abolish the Plan at the 85th Ordinary General Meeting to be held on August 26, 2022.It was abolished at the conclusion of the General Meeting of Shareholders. In addition, following the abolition of the Plan, the General Meeting of Shareholders resolved to terminate and pay retirement benefits to directors (excluding outside directors) and auditors (excluding outside auditors) who continue to serve in office, for the period of their service up until the abolition of the Plan, and such benefits will be paid at the time of the retirement of the applicable directors or auditors.

Regarding the RS for Directors, a resolution was passed at the 82nd Ordinary General Meeting of Shareholders held on August 23, 2019 to pay remuneration for the grant of restricted stock to Eligible Directors (excluding non-executive Directors and Outside Directors) in a framework separate from the remuneration framework resolved at the General Meeting of Shareholders held on August 27, 2021, with the total amount of monetary remuneration claims to be paid being within 100 million yen per year, and the total number of common shares issued or disposed of by the Company being within 55,000 shares per year (however, if a stock split (including a free allotment of common shares of the Company) or a stock consolidation of the Company's common shares occurs after the date on which this proposal is approved, or if any other reason arises requiring an adjustment to the total amount of the Company's common shares issued or disposed of as restricted stock, the total amount will be adjusted within a reasonable range.) as stated below. The number of Eligible Directors at the conclusion of the General Meeting of Shareholders will be four.

The Board of Directors has determined that the content of remuneration, etc. for this fiscal year is in accordance with the decision-making policy, since it was consulted in advance with the Nomination and Remuneration Committee within the approved limits, and was decided upon through deliberation, including consistency, at a meeting of the Board of Directors, which is composed of Directors who have the authority to decide the amount and calculation method of individual Director remuneration. The amount of remuneration for each Audit & Supervisory Board Member is determined through discussion among the Audit & Supervisory Board Members.